Private landlords can expand their portfolio without incurring punitive new stamp duty tax

Private landlords have grown used to being under the cosh, although one wonders where we would be without them.

In the 19 years since buy-to-let mortgages were first introduced, the UK’s private rented sector has more than doubled, from 2.4 million rented properties in 1996, to 4.9 million at the end of 2014.

Most private landlords are ambitious, go-getting folks, capable of doing things off their own bat and, as a result, the average buy-to-let (BTL) owner has a portfolio of four properties, which he intends holding for between 15-20 years.

In other words, though it’s often depicted otherwise, BTL is no route for those seeking fabulous overnight gains. Property has to be nurtured and maintained if it is to produce a consistent, half-decent yield and, ultimately, an acceptable return when it is sold.

Yet recent changes to the tax system have made life increasingly difficult for would-be landlords and for those wishing to expand their existing portfolio.

Earlier this year, the Chancellor announced the withdrawal of two of the most attractive BTL tax break: mortgage interest relief and the 10% wear-and-tear allowance, a move which will hit almost all landlords when it comes into force next year.

However, George Osborne produced a further unwelcome surprise in his Autumn statement when he announced the introduction of a punitive tax designed to make it more difficult for small investors to enter the BTL sector; the tax is equally restrictive for existing landlords keen to enlarge their property portfolios.

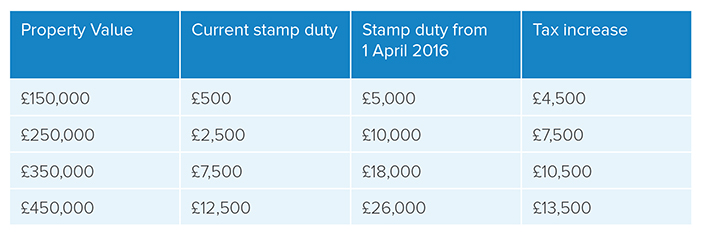

From April 2016, the Government is to introduce new rates of stamp duty for buy-to-let properties and second home purchases, set 3% above the rate for first home purchases.

On a buy-to-let property costing £275,000, stamp duty will more than treble, from the current level of £3,750 to £12,000. The new rate applies to all second home purchases, not just BTL, which means investors cannot buy a house for personal use and convert it to a rental property at a later date.

Stamp duty cannot be added to a mortgage, nor can it be charged against profits; it becomes a tax burden sunk into the property as a cost and can only be offset against capital gains tax, if applicable, when the landlord sells.

Current BTL owners are unaffected (for the time being), but landlords thinking of building their portfolios should first refer to the table below which highlights the degree to which they could be hit by this punitive measure after it comes into effect on 1 April 2016.

These eye-watering tax increases will undoubtedly put a hold on many landlords’ expansion plans, but this is not a group of people inclined to sit on their hands. Fortunately, there’s a way in which landlords can continue to enlarge their portfolios without incurring any tax at all while improving longer-term returns.

To show how this can be done, let’s say we fast-forward to April 2016 where we find a BTL investor who owns a fully-let property valued at £275,000 on which he has a £175,000 interest-only mortgage costing 3.95%; it yields 4.75%. He’s interested in buying a similarly-priced house, currently yielding 4.5%, but balks because stamp duty has risen from £3,750 to a whopping £12,000, a sum he must find from his own cash reserves.

Foregoing the opportunity to bolster the Treasury’s reserves, he decides instead to add value to his current property in the form of a loft extension, creating another large, lettable bedroom with en-suite facilities, at a cost of £35,000.

Fortunately, he can borrow every penny of the cost and does so, bringing his mortgage up to £210,000 on which he pays the same 3.95% rate, adding £115 to his monthly bill.

However, let’s assume he lets the newly-created bedroom with its own bathroom facilities at a ridiculously low rate of £400 per month, or £4,800 a year, boosting his rent roll from £13,062 to £17,862.

In a matter of weeks, our BTL investor has improved the yield on his property by almost 15% – when measured against borrowings – from 7.4% to 8.5% per annum, comfortably covering his increased expenses.

However, the value of his property has also headed north, from £275,000 to £315,000, which means the gross rental yield has also soared by more than 19%, from the original 4.75%, to 5.67%.

And there’s more. It’s what we call capturing ‘accelerated value’.

For the sake of argument, let’s say that for the next decade, property values will, on average, rise by 4% a year. In other words, we could reasonably expect a home valued today at £275,000 to be worth £407,067 in ten years’ time.

It follows that a BTL investment worth £315,000 will, by applying the same metric, be worth £466,276, or 14.5% more at precisely the point at which the landlord may be wishing to sell.

Private landlords less than happy with George Osborne’s attempts to apply the brakes to their expansion plans should be thinking about getting the most from their existing assets without enriching the Treasury. Converting a property’s loft is the perfect way of doing this.

© Jon Pritchard Limited 2015

Leave a comment

You must be logged in to post a comment.